CGC Ventures is part of Continental Grain Company, a 200-year old family-owned company that was birthed from a love of agriculture. CGC is the investment branch of Continental and focuses on investing in early-stage businesses. We caught up with investor Chris Abbott to discuss the industry, the next hot companies and how the midwest can lead the pack in terms of ag-tech.

Q&A

Fargo for the last 100 years has been playing a role in the ag-tech industry. Compared to other regions around the U.S. that are working in ag-tech, how would you rank Fargo?

I think Fargo has out-performed most regions when it comes to innovation, especially when you think about it on a per-capita basis. Fargo also has what most regions don’t have, which is leading domain expertise in agriculture and food production. When you complement domain expertise with Fargo’s supportive local investment environment to fund new businesses, it creates a great recipe for success. Ames, IA, is also great at this. Minneapolis is also good and getting better.

There’s a lot of work being done in the Twin Cities, Fargo, Ames, IA, and around the Midwest. How can all these Midwest cities work together to grow our recognition in ag tech?

I think these areas have the most domain expertise, hands down. These regions also have massive amounts of capital, due to successful businesses built in the region over the past century. The next challenge will be continuing to drive innovation from within the food/ag majors, as well as the universities and non-ag technology companies, and support that innovation with capital and strategic guidance. If you have the innovation, you need to create support from the food and ag value-chain throughout the Midwest and the investment community. If you have innovation, strategic support and investment capital, it all becomes self-fulfilling. Look at what Silicon Valley has done with these three legs of the stool and look at the result the past 20 years. We can do that in the Midwest if entrepreneurs, investors, strategics and thought leaders build support systems to foster the innovation.

Tell us about some of the businesses you’ve already invested in.

We have a great portfolio of companies throughout the ag/food value chain. We have 13 investments across real-time, in-season data (hardware/software), proven biological technologies in crop protection and nutrition, alternative protein and plant-based diets, novel food ingredients, animal health/nutrition and supply chain efficiency. We are fortunate to have incredible founders and teams that we’ve backed at each company. Each of these companies solves a critical need in the broader value chain and when strung together, can create meaningful, global change for the better. As a result, we don’t expect a typical venture capital success rate, we expect our success rate to be much better.

You obviously work with a lot of ag-tech businesses. What are you looking for in a successful company?

We are looking for great teams, solving real problems, that can show product-market-fit. We are an active partner and shareholder for our companies and can be most helpful once a company is in commercialization mode. We are less effective if a company is very early stage, focused purely on technology R&D. The companies that we have invested in all have a common theme – great teams. It is often over-stated, but having the right team makes all the difference. Google wasn’t the first search engine, Facebook wasn’t the first social network, Apple didn’t invent the cell phone, but ultimately those companies became market leaders as their teams listened to consumers, had a relentless focus on product development and serviced customers like nobody else. Same equation holds true in ag-tech.

What areas of ag-tech are the quickest growing and have the most potential for exciting innovations?

Ag-tech is interesting. I would say biologicals and digital ag remain very exciting. Digital ag has seen slower adoption in most cases, but certain areas where technology is used as a decision support tool (for growers, agronomists and retailers), solutions have been adopted and continue to grow rapidly. We are seeing that in our investment in Sentera, which attaches their sensors to drones to gather data, in real-time, to provide agronomists and growers with weed pressure maps, nitrogen status and stand/emergence. That is data, not pictures, so it pushes automatically from the drone sensor into the cab of the tractor and into the monitors. You can actually “live stream” your weed pressure map on your iPhone as the drone flies on autopilot over the field (that is even better than Netflix!) That capability eliminates lots of hours of scouting and creating maps by agronomists, letting them focus on higher-value tasks and spending time with their customers.

Biologicals offer growers the ability to switch away from synthetic chemistry and not lose performance or increase their risk. The world is quickly realizing that synthetic chemistry isn’t good for people, plants or the planet. But growers need real biological solutions to replace their chemistry. There is lots of innovation and regulatory support to get effective biological products in the hands of growers, which hopefully allows growers to increase their profitability and capture more value as they produce better, differentiated crops. At least it gives them more leverage in the value chain. We have backed Greenlight Bio (RNA technology platform) and Vestaron (biopesticide, peptide technology) in the crop protection space, as well as Pivot Bio, the industry leader in Nitrogen biological replacement technology.

I’m curious about working for a 200-year old company, how do you stay innovative and encourage displacement in the industry?

I am thankful every day to work at a great family-owned business like Continental Grain. We have the best people in the industry, no question. We value disruption and intellectual honesty, but also take a long-dated view of the food/ag value chain’s evolution. Complacency in food/ag is fatal. CGC has spent 200+ years, over six generations, continually reinventing itself. When you have that type of focus and a long-term view, you can build pretty incredible businesses.

Talk about the problem that we’re facing as a global population to ensure we’re being environmentally friendly and going to be able to feed everyone.

I’ve spent the past decade working in sustainability and agriculture technology. We all know the impact agriculture can have. Agriculture uses most of the freshwater on the planet, consumes massive amounts of energy and needs to tackle pollution. However, we also feed billions of people and continually focus on solving global human health and environmental problems. Growers are innovators, always have been and always will be. If someone can figure it out, I’d bet on agriculture.

Think holistically for a second about a point in time where a grower can fly a drone to get a full field scouted in minutes, push that data into the cab and spray a biological that doesn’t harm bees, soil or consumers. Then, layer in the fact that same grower also applied a Pivot microbe at planting (or seed coating applied), which delivers 100 pounds of nitrogen to the corn, has no need for side-dressing, no risk of runoff, water contamination, soil degradation, etc. And, that same grower can get paid more for their differentiated crop, growing practices and carbon sequestration. These solutions are available today. They drive grower efficiency and profitability, improve environmental health and address human health issues around obesity, processed foods, exploding cancer rates, etc. Agriculture will solve the issues around global sustainability and human health – but we all need to support our growers and innovators.

Funding in Ag-Tech

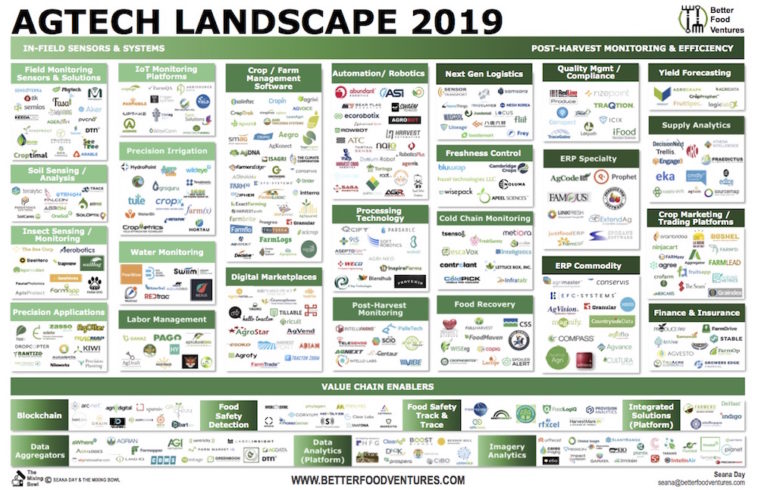

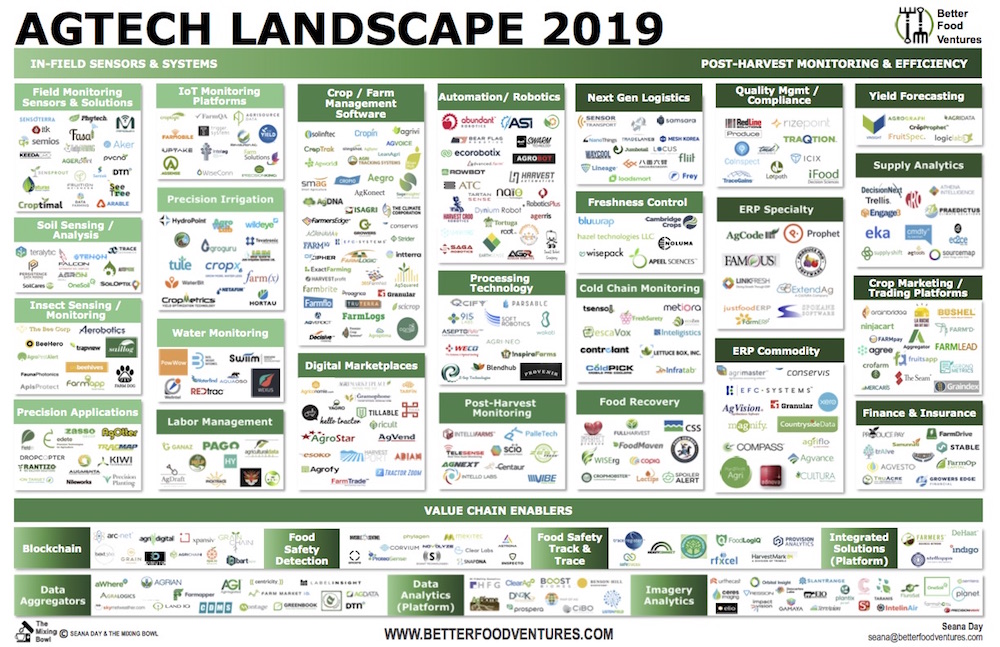

Last year, according to AgFunder, nearly $17 billion was invested in ag-tech. This graphic from Better Food Ventures highlights the large number of companies that are entering into this space.

About Chris

Chris joined the CGC Ventures team in 2018. Previously, Chris led Craig-Hallum Capital Group’s investment banking group efforts focused on sustainability, agriculture and ag-tech. Prior to Craig-Hallum, Chris worked at Piper Jaffray & Co. and AWJ Capital Partners, focused broadly on technology, sustainability, healthcare and consumer companies. He also currently serves on the Boards of several CGCV companies. Chris loves to compete in triathlons, basketball and tennis. He is an avid supporter of charity: water and InnerCity Tennis.